#interestrates #interestratesarelow #interestratesaredown

Wednesday, December 16, 2020

Interest Rates Are Projected to Stay Low

In the latest projections from Freddie Mac, interest rates for a 30-year fixed-rate mortgage are expected to remain at or near 3% next year. These low rates will continue to make homes more affordable, driving demand for housing in 2021.

Sunday, November 15, 2020

Million-dollar home sales soar in metro Phoenix despite pandemic

In the midst of a pandemic, wealthy buyers are snapping up metro Phoenix's million-dollar homes at a record pace.

Monday, October 12, 2020

COVID-19 Has Changed The Housing Market Forever. Here’s Where Americans Are Moving (And Why)

Amid all the uncertainty brought on by COVID-19 over the past six months, one thing is assured: the pandemic has re-ordered real estate markets across the board on an unprecedented scale.

Sunday, September 6, 2020

Phoenix Real Estate Market 2020: Housing Prices & Forecast

Even after suffering from the pandemic, the Phoenix housing market 2020 still comes out on top. As we saw Arizona real estate market thriving & becoming sizzling hot in the past couple of years, even the rise in mortgage rates was believed not to affect it. We've been seeing real estate appreciation rates increasing year-over-year in the entire metro area. The Greater Phoenix area was also predicted to be among the top housing markets in the year 2020. It is now clear that the pandemic could not change that prediction. It could only pause sales, which in turn created a huge pent up demand.

Monday, May 25, 2020

Historical Data Shows Housing Market Will Boom After The 2020 Crisis, And So Will Bitcoin

Historical data from the late 1990s show a financial crisis is often followed with a steep increase in housing prices. If real estate grows in a similar manner as the 2000s, safe haven assets like gold and potentially Bitcoin may follow.

Saturday, May 23, 2020

FHFA Announces Refinance and Home Purchase Eligibility for Borrowers in Forbearance

Washington, D.C. – Today, to support borrowers and mortgage servicers, the Federal Housing Finance Agency (FHFA) announced that Fannie Mae and Freddie Mac (the Enterprises) have issued temporary guidance regarding the eligibility of borrowers who are in forbearance, or have recently ended their forbearance, looking to refinance or buy a new home.

Tuesday, May 19, 2020

FHFA Issues Guidance on Refinances, Purchases While in Forbearance

The Federal Housing Financing Agency (FHFA) announced Tuesday that Fannie Mae and Freddie Mac have issued temporary guidance regarding the eligibility of borrowers in forbearance, or recently ended their forbearance, looking to refinance and purchase a home.

Sunday, May 17, 2020

Housing markets in most big cities struggle because of coronavirus shutdowns, but these markets buck the trend

Coronavirus has run roughshod over most of the nation's big-city real estate markets for more than six weeks now, paralyzing agents, halting showings and causing double-digit drops in listings and new inventory as frightened sellers withdraw their properties from consideration.

Sunday, May 10, 2020

Metro Phoenix rents climb 3 times as fast as US average. Will eviction aid be enough?

Metro Phoenix rents climbed nearly three times as fast as the average U.S. increase during the past 12 months, despite a slight reprieve for tenants last month.

Sunday, April 26, 2020

Metro Phoenix home prices hit record in March but sales are slowing

Metro Phoenix median home price hit a record in March, but most of the sales that drove the price up to $302,500 were negotiated before COVID-19 hit.

Sunday, February 9, 2020

Scottsdale's Taylor Morrison to be 5th biggest U.S. builder; shareholders approve $2.4B deal

Scottsdale-based Taylor Morrison is about to become the fifth biggest homebuilder in the U.S.

Squeezed Out: Arizona needs at least 100,000 more affordable homes now

Arizona needs at least 100,000 apartments or houses that people living and working in the state can afford.

Thursday, February 6, 2020

Arizona's biggest parking garage is under construction. Here's where

Arizona's biggest parking garage is going up in the middle of Phoenix in one of its oldest shopping centers — Park Central Mall.

Real estate startup Homie plans to expand to more cities with $23 million in Series B funding

Homie has made an impression among younger, first-time home buyers in the Utah and Arizona markets for cutting out the traditional closing costs, 6% real estate commissions and arduous paperwork associated with traditional home sales. It now plans to explore opening up in three new markets and will begin a Vegas launch in March with a fresh infusion of $23 million in Series B equity financing.

How Understanding Long-Term Care Can Expand Reverse Mortgage Business

Encouraging financial preparedness in later life is a core discussion point for people who work in the reverse mortgage profession, and industry literature is rife with examples concerning ways in which the wealth and savings of older Americans can often be unprepared to withstand and extend through a senior's retirement. One of the realities that older people often must contend with, regardless of the status of their retirements, is long-term care (LTC).

All Five Federal Mortgage Programs Should Treat Student Loan Debt the Same Way

Many of the 44.7 million Americans with student loan debt are also in their prime homebuying years. And more than 8 million of them use income-driven repayment (IDR) plans for their student loans, which require special calculations for determining mortgage lending.

Friday, January 31, 2020

FICO Launches New Credit Scoring Model: Your Score Might Change, But Your Mortgage Prospects? Probably Not

A whopping 110 million Americans will likely see their credit scores change this summer, thanks to a newly announced credit scoring model from Fair Isaac Corp.—the company behind FICO scores.

Best Regards,

Lillian Wong

Sr. Mortgage Advisor

NMLS 630337

NEXA Mortgage

2450 S Gilbert Rd #210

Chandler AZ 85286

480.650.5412

www.lillianwong.net

lwong@nexamortgage.com

Sunday, January 26, 2020

Ready to Retire? Not Until You've Done 3 Things

To protect yourself from surprises, here are three steps to take, starting at 10 years before retirement, five years before and finally one year before.

Sunday, January 19, 2020

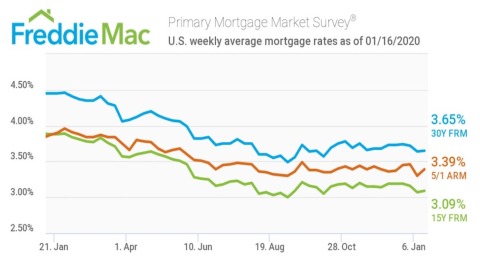

Rates Not Fazed by Phase One

This past week was filled with so much good news. The biggest of which was the signing of Phase One of the U.S. and China trade pact.

This trade deal is a very positive development for the U.S., China, and the world, and paves the way for future business investment and other trade deals around the globe. This also removed what was a big uncertainty for many months.

The economic data was already amazing with the following reports coming in better than expectations:

This trade deal is a very positive development for the U.S., China, and the world, and paves the way for future business investment and other trade deals around the globe. This also removed what was a big uncertainty for many months.

The economic data was already amazing with the following reports coming in better than expectations:

- Small Businesses reported robust quarterly earnings.

- Retail Sales were strong signaling that the consumer continues to spend and drive the U.S. economic expansion.

- Philadelphia Fed Manufacturing Index surged this month.

- Initial Jobless Claims declined and remain at 50-year lows.

And speaking of better than expectations, we also watched the start of corporate earnings season and most of the big banks handily beat expectations.

All of this good news has pushed Stocks to all-time highs, but at the same time Mortgage Bonds and home loan rates remained right at the best levels in three years... remarkable.

All of this good news has pushed Stocks to all-time highs, but at the same time Mortgage Bonds and home loan rates remained right at the best levels in three years... remarkable.

With the U.S.-China Phase One trade pact having been signed this past week, the financial markets will get back to what will drive the trading activity in the days and weeks ahead, earnings season.

A slew of earnings reports will be released this week which will directly impact Stocks, Bonds, and home loan rates. If the numbers continue to stream in positive, it could push Bond prices lower, and rates higher. The opposite is also true.

Economic data will be extremely light with just Existing Home Sales and Weekly Initial Jobless Claims being released, so the focus will be on the earnings data.

A slew of earnings reports will be released this week which will directly impact Stocks, Bonds, and home loan rates. If the numbers continue to stream in positive, it could push Bond prices lower, and rates higher. The opposite is also true.

Economic data will be extremely light with just Existing Home Sales and Weekly Initial Jobless Claims being released, so the focus will be on the earnings data.

Low mortgage rates boost the economy by cutting home financing costs, which puts more money in the wallets of consumers to put toward the purchases that account for about 70% of America's GDP.

Mortgage rates remain low with the 30-year fixed rate mortgage averaging 3.65% and along with the strong job market, both are fueling the consumer driven economy by boosting purchasing power which will certainly support housing market activity in the coming months.

The 15-year fixed rate mortgage averaged 3.09% this week, slightly higher from last week's rate of 3.07% and this time last year at 3.88%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.39% this week, slightly higher from last week's rate of 3.3% and at this time last year at 3.87%.

All U.S. financial markets are closed on Monday in observance of Martin Luther King Jr. Day.

Bottom line: the U.S. economy remains quite strong with zero chance of a recession anytime soon, yet at the same time home loan rates have not moved higher, giving many an incredible opportunity to purchase or refinance a home.

Bottom line: the U.S. economy remains quite strong with zero chance of a recession anytime soon, yet at the same time home loan rates have not moved higher, giving many an incredible opportunity to purchase or refinance a home.

Sunday, January 5, 2020

Millennials Will Propel the U.S. Housing Market in 2020

Millennials are anticipated to drive the U.S. housing market forward in 2020 more than ever, with large cohorts expected to either purchase their first home or decamp from city to suburb and trade up, according to an economic forecast published by realtor.com on Wednesday.

Subscribe to:

Posts (Atom)